Top Stories from Sky News

-

Sunak pledges to remove benefits for people not taking jobs after 12 months

Sunak pledges to remove benefits for people not taking jobs after 12 monthsPeople who are fit to work but do not accept job offers will have their benefits taken away after 12 months, the prime minister has pledged.

-

Met Police apologises for using phrase 'openly Jewish' as campaigner accuses force of 'victim-blaming'

Met Police apologises for using phrase 'openly Jewish' as campaigner accuses force of 'victim-blaming'The Metropolitan Police has apologised after an officer prevented an antisemitism campaigner from crossing a road near a pro-Palestinian march because they were "openly Jewish".

-

Labour blames 'shoplifters' charter' for surge in retail crime

Labour blames 'shoplifters' charter' for surge in retail crimeA "shoplifters' charter" has seen thefts rise significantly - to about one offence every minute - but police are charging fewer people, according to Labour.

-

Police investigate Joey Barton tweets as ex-footballer hits out at 'attempt to intimidate' him

Police investigate Joey Barton tweets as ex-footballer hits out at 'attempt to intimidate' himFormer Premier League footballer Joey Barton has hit out at "an attempt to intimidate" him and his family after officers contacted him about comments he posted on social media.

-

Stout attracts unlikely new legion of fans as sales soar

Stout attracts unlikely new legion of fans as sales soarA pint of deep, dark stout with a creamy top may be thought of as an acquired taste but it seems the silky-smooth beer is attracting a legion of unlikely new fans.

-

London Marathon: Four mistakes to avoid as the big day looms

London Marathon: Four mistakes to avoid as the big day loomsIt's crunch time now for those who have been training for this year's London Marathon.

-

Tories warned Menzies misuse of funds claims 'constituted fraud' but whistleblower told there was no 'duty' to report it

Tories warned Menzies misuse of funds claims 'constituted fraud' but whistleblower told there was no 'duty' to report itThe Conservatives were warned ex-Tory MP Mark Menzies's alleged misuse of party funds may have constituted fraud but the whistleblower was told there was no duty to report it

-

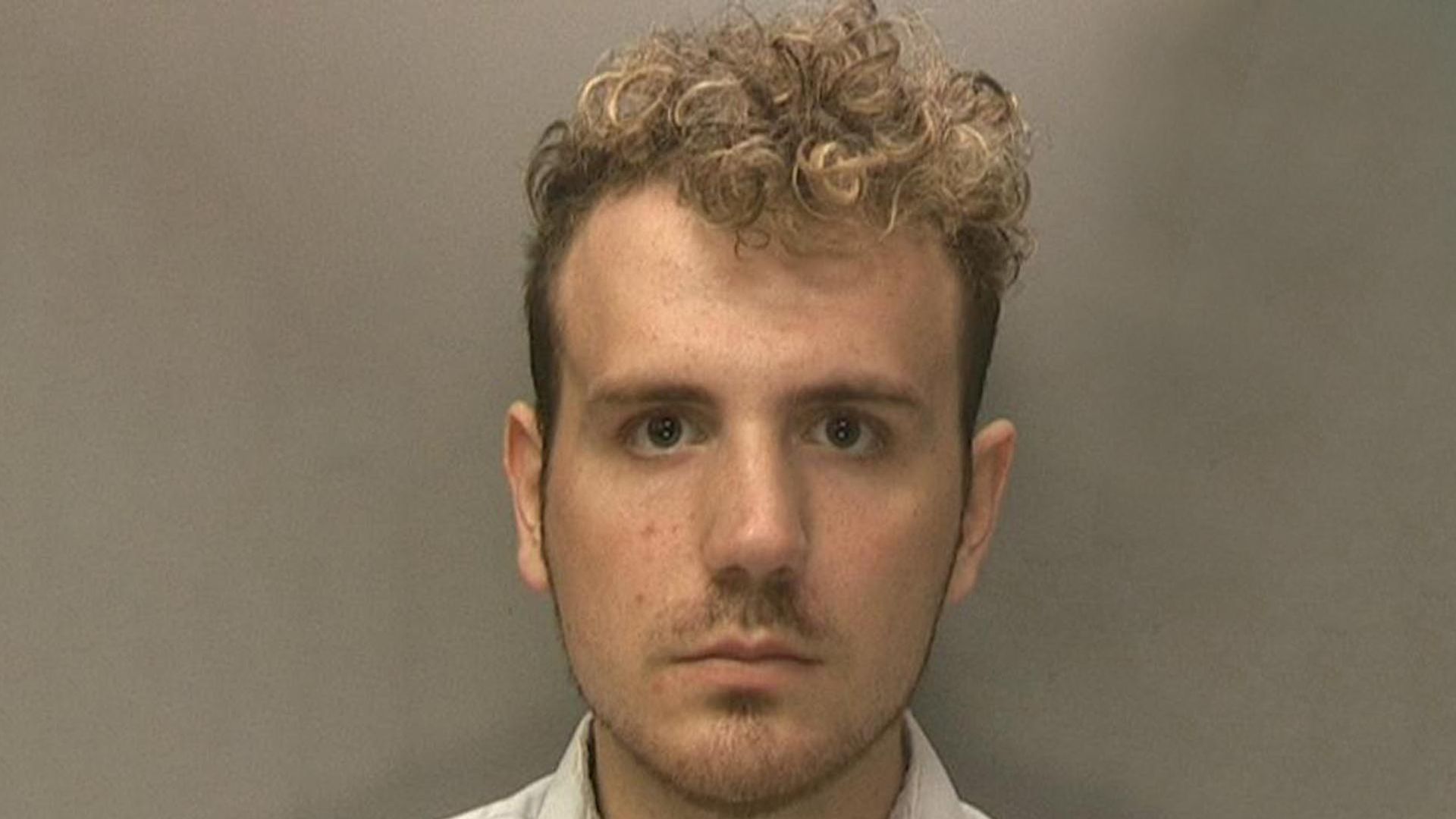

SWAT team shot man in face after UK gamer faked hostage situation

SWAT team shot man in face after UK gamer faked hostage situationA British video gamer who faked a hostage situation leading to another man suffering life-changing injuries after armed units were tricked into shooting him has been sentenced in the first case of its kind in the UK.

Top Entertainment Stories from Sky

-

The female gamers competing for thousands of pounds at first event of its kind in UK

The female gamers competing for thousands of pounds at first event of its kind in UKThe UK's first professional women's gaming tournament of its kind starts on Saturday.

-

Marriage, babies and bad boyfriends: Breaking down Swift's new album

Marriage, babies and bad boyfriends: Breaking down Swift's new albumAs the title suggests, The Tortured Poets Department is a break-up album, and one that doesn't disappoint in deconstructing Taylor Swift's failed relationships and old boyfriends gone bad.

-

Taylor Swift reveals 'secret' double album in '2am surprise'

Taylor Swift reveals 'secret' double album in '2am surprise'Taylor Swift has revealed her latest release is a "secret double album" - with 15 more tracks than fans were expecting.

-

Taylor Swift's boyfriend hails latest album as 'unbelievable' - as new track appears to say farewell to British ex

Taylor Swift's boyfriend hails latest album as 'unbelievable' - as new track appears to say farewell to British exTaylor Swift is one of the world's best-selling artists, a billionaire, and a record breaker. And she's just 34.

Business News

-

Grocery delivery app Getir prepares to exit UK market

Grocery delivery app Getir prepares to exit UK marketGetir, the grocery delivery app once valued at nearly $12bn (£9.7bn), is close to pulling the plug on its operations in Britain in a move that would spark concerns for well over 1,000 jobs.

-

Pension funds brace for £30bn hit from Gove leasehold reforms

Pension funds brace for £30bn hit from Gove leasehold reformsPension funds are braced for a hit worth tens of billions of pounds as Michael Gove, the levelling up secretary, tries to salvage his ambition of overhauling Britain's centuries-old property leasehold system.

-

Post Office lawyer 'takes no pride' working for the company

Post Office lawyer 'takes no pride' working for the companyA lawyer for the Post Office at the height of the Horizon IT scandal has told the public inquiry he feels "no pride" to be employed by the company.

-

Labour blames 'shoplifters' charter' for surge in retail crime

Labour blames 'shoplifters' charter' for surge in retail crimeA "shoplifters' charter" has seen thefts rise significantly - to about one offence every minute - but police are charging fewer people, according to Labour.