Schedule

-

-

-

-

Brian Noon with The Feel Good Afternoon

Brian Noon with The Feel Good Afternoon2:00pm - 4:00pm

The Feel Good Afternoon with the Feel Good Three at Three

Top Stories from Sky News

-

Bank of England governor talks up interest rate cut prospects as inflation eases to 3.2%

Bank of England governor talks up interest rate cut prospects as inflation eases to 3.2%The governor of the Bank of England has signalled the UK is still on course for an interest rate cut as official figures show a further easing in the pace of price growth in the economy.

-

Man found dead at property after report of 'serious ongoing incident'

Man found dead at property after report of 'serious ongoing incident'A man's body has been found at a property in Bradford.

-

Smacking children should be banned in England and Northern Ireland, doctors say

Smacking children should be banned in England and Northern Ireland, doctors saySmacking children should be banned throughout the UK as current laws are "unjust and dangerously vague" - making it harder to identify when youngsters are being abused, children's doctors have said.

-

Record job losses despite an industry on the rise - what's going on in UK gaming?

Record job losses despite an industry on the rise - what's going on in UK gaming?"I had just woken up and I got an email that said, 'We're going to have a company-wide meeting'. I knew right away."

-

Taylor Swift fans 'could have lost £1m due to Eras ticket scams'

Taylor Swift fans 'could have lost £1m due to Eras ticket scams'Taylor Swift fans in the UK could have already lost more than £1m to con artists pretending to sell concert tickets for her Eras tour, a major bank has estimated.

-

Vigil for WPC Yvonne Fletcher as hopes grow for prosecution 40 years after 'callous' murder

Vigil for WPC Yvonne Fletcher as hopes grow for prosecution 40 years after 'callous' murderMore than a thousand people are expected to flood a pretty London square to celebrate the life of a police officer murdered there exactly 40 years ago.

-

'Social inequalities' pushing disproportionate number of children into care in the North

'Social inequalities' pushing disproportionate number of children into care in the NorthOne in every 52 children in Blackpool is in care compared with one in 140 across England, according to new analysis, which researchers say exposes "deeply rooted social inequalities".

-

British Olympic Association chief criticises move to give prize money to track and field gold medallists

British Olympic Association chief criticises move to give prize money to track and field gold medallistsA decision by athletics bosses to pay Olympic gold medallists was inappropriate and has created problems with other sports, Team GB's boss has told Sky News.

Top Entertainment Stories from Sky

-

Taylor Swift fans 'could have lost £1m due to Eras ticket scams'

Taylor Swift fans 'could have lost £1m due to Eras ticket scams'Taylor Swift fans in the UK could have already lost more than £1m to con artists pretending to sell concert tickets for her Eras tour, a major bank has estimated.

-

Why are thousands of video game workers losing their jobs?

Why are thousands of video game workers losing their jobs?"I had just woken up and I got an email that said, 'We're going to have a company-wide meeting'. I knew right away."

-

Johnny Depp says he tried to talk director out of casting him in new film

Johnny Depp says he tried to talk director out of casting him in new filmJohnny Depp has said he tried to talk the director of his new film out of casting him in one of the lead roles.

-

Creating fake sexual images of another person to become a criminal offence

Creating fake sexual images of another person to become a criminal offenceCreating fake sexual images of another person will become a criminal offence, under a new law announced on Tuesday.

Business News

-

Bank of England governor talks up interest rate cut prospects as inflation eases to 3.2%

Bank of England governor talks up interest rate cut prospects as inflation eases to 3.2%The governor of the Bank of England has signalled the UK is still on course for an interest rate cut as official figures show a further easing in the pace of price growth in the economy.

-

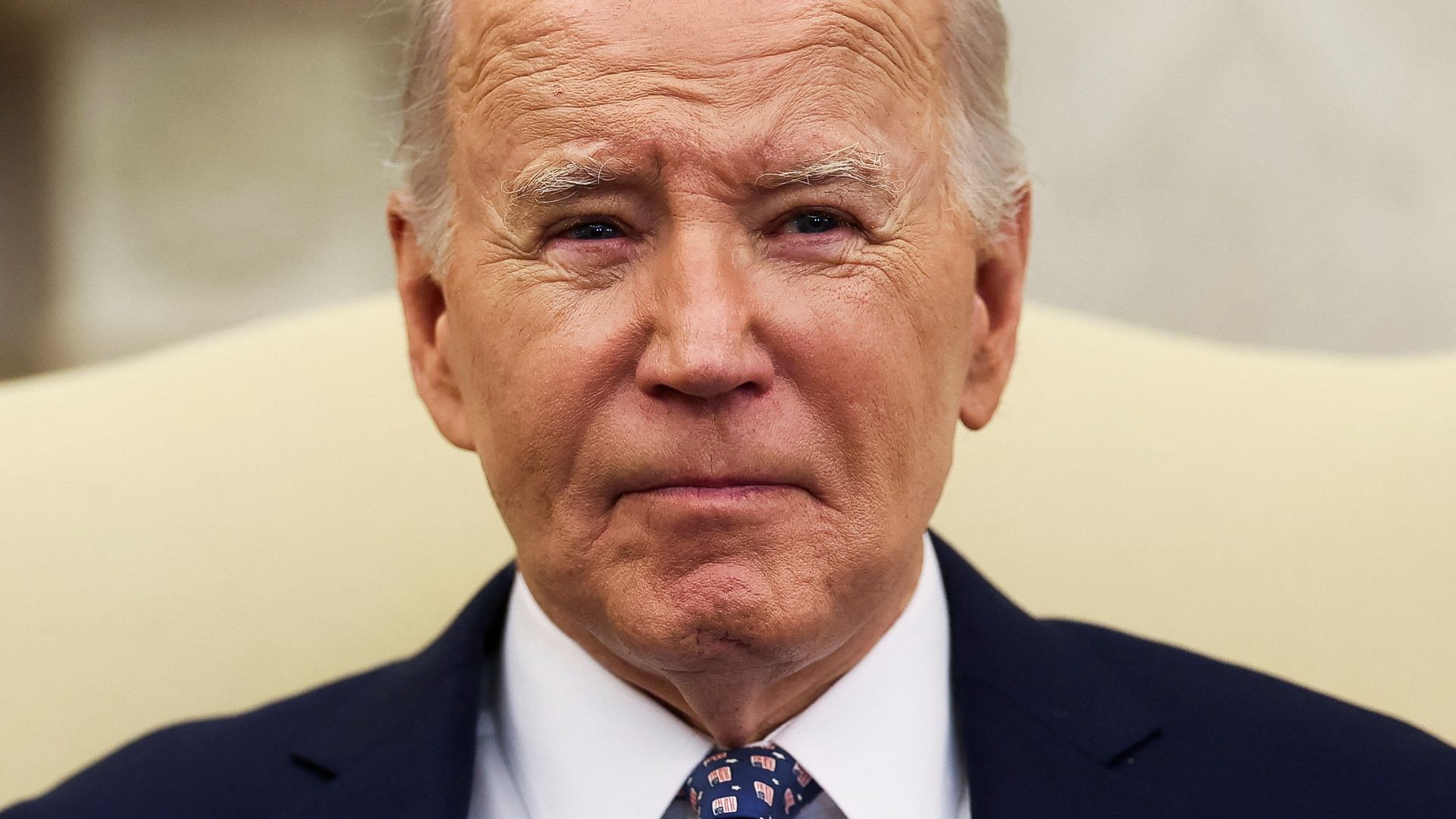

The US economy is the envy of Europe - so why's it suffering a 'vibecession'?

The US economy is the envy of Europe - so why's it suffering a 'vibecession'?In the circumstances, the numbers could hardly look much better.

-

Government would not have accepted ending Horizon software, ex-Post Office CEO says

Government would not have accepted ending Horizon software, ex-Post Office CEO saysThe government would not have accepted faulty accounting software Horizon being phased out, a former Post Office chief executive told the inquiry into the wrongful prosecution of sub-postmasters.

-

UK growth forecasts cut by IMF - as inflation predictions revealed

UK growth forecasts cut by IMF - as inflation predictions revealedThe UK economy is going to grow less than expected this year - with the International Monetary Fund warning the country will remain the second worst performer in the G7.