Schedule

-

-

-

Brian Noon with The Feel Good Afternoon

Brian Noon with The Feel Good Afternoon2:00pm - 4:00pm

The Feel Good Afternoon with the Feel Good Three at Three

-

Top Stories from Sky News

-

Two horses which bolted through central London in a 'serious condition'

Two horses which bolted through central London in a 'serious condition'Two horses which bolted and charged through central London are in a "serious condition", a minister has said.

-

Why is it suddenly cold and when will the weather get warmer?

Why is it suddenly cold and when will the weather get warmer?When temperatures hit nearly 22C in parts of England earlier this month, people might have thought that spring had finally sprung.

-

Officers who failed to spot murder victim had been shot could face misconduct inquiry

Officers who failed to spot murder victim had been shot could face misconduct inquiryOfficers who failed to spot a murder victim had been shot could face a misconduct inquiry, a former senior detective has told Sky News.

-

Young girls in UK drink, smoke and vape 'more than boys'

Young girls in UK drink, smoke and vape 'more than boys'Young girls in the UK drink, smoke and vape more than boys, a major study suggests.

-

'They mess it up every time': New poll suggests voters no longer believe what politicians say

'They mess it up every time': New poll suggests voters no longer believe what politicians sayJune gives me a wry smile when I ask her if she trusts politicians. But it soon fades.

-

Teenage girl arrested on suspicion of attempted murder after stabbings at school

Teenage girl arrested on suspicion of attempted murder after stabbings at schoolA teenage girl has been arrested on suspicion of attempted murder after two teachers and a pupil were stabbed at a school in West Wales.

-

Three men arrested after deaths of five people, including a child, who attempted to cross Channel

Three men arrested after deaths of five people, including a child, who attempted to cross ChannelThree men have been arrested after the deaths of five people - including a seven-year-old girl - who were attempting to cross the English Channel.

-

Shetlands spaceport that hopes to launch 30 rockets a year given crucial safety licence

Shetlands spaceport that hopes to launch 30 rockets a year given crucial safety licenceA spaceport that hopes to launch the first rockets vertically into orbit from British soil has been given a crucial safety licence.

Top Entertainment Stories from Sky

-

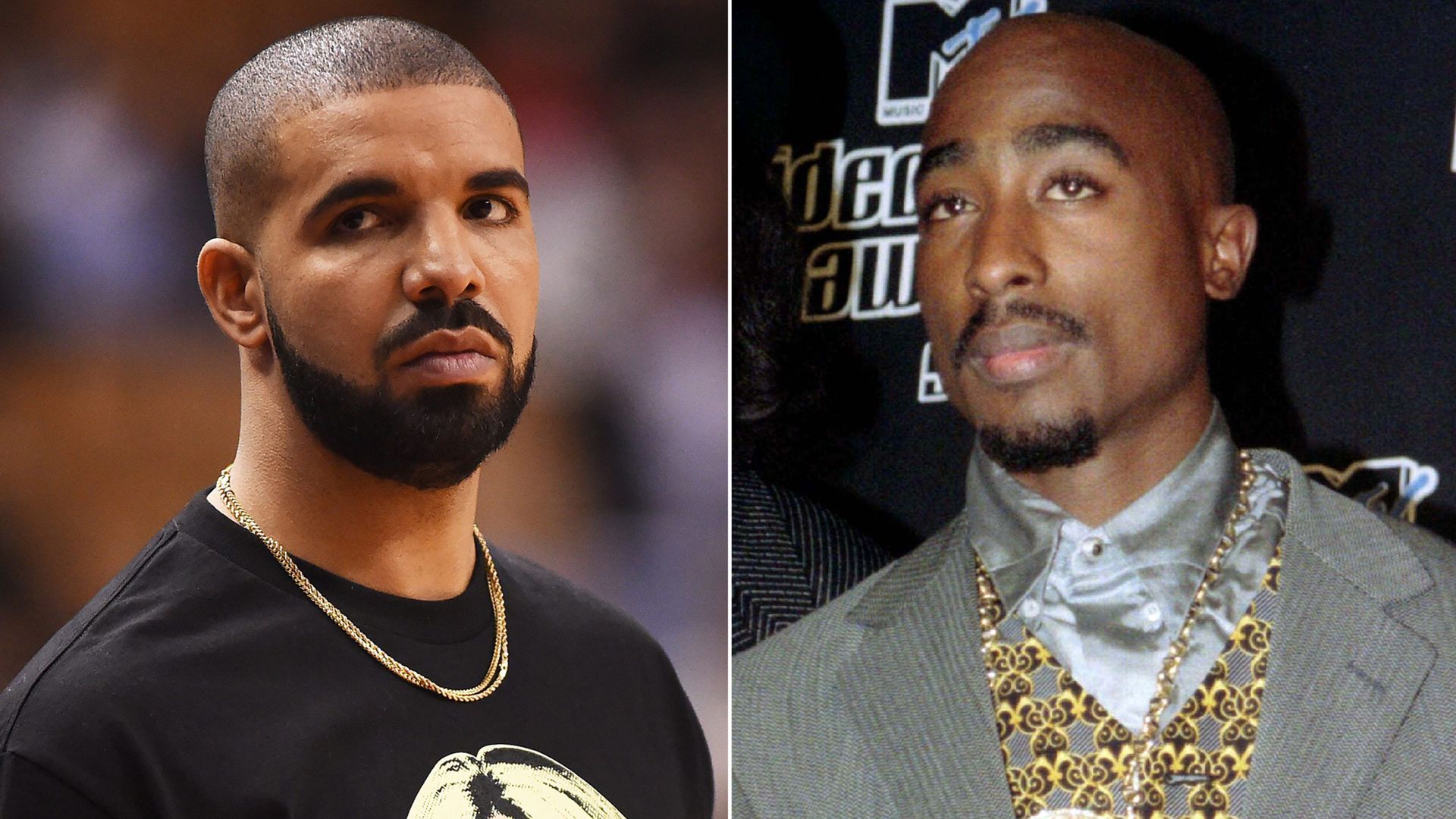

Drake ordered to delete track featuring AI-generated voice of Tupac

Drake ordered to delete track featuring AI-generated voice of TupacTupac Shakur's estate has threatened to sue Drake and ordered him to delete a track featuring an AI-generated copy of the late rapper's voice.

-

Baby Reindeer writer tells fans to stop speculating about who characters are in real life

Baby Reindeer writer tells fans to stop speculating about who characters are in real lifeRichard Gadd has urged fans of his hit show Baby Reindeer to stop speculating about who the characters in his show are based on in real life.

-

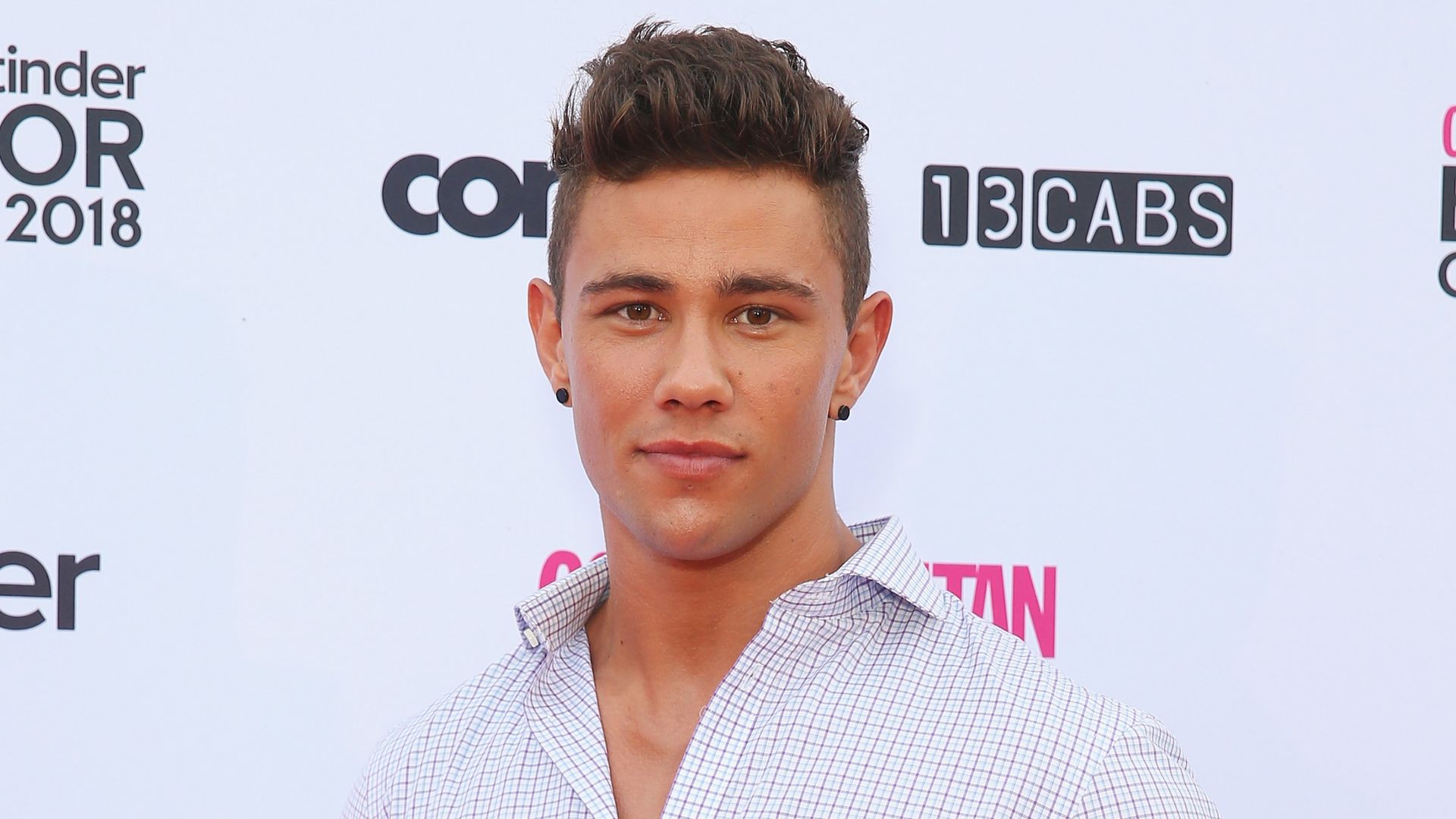

Manhunt for Home and Away star accused of assault

Manhunt for Home and Away star accused of assaultPolice in Australia have launched a manhunt for former soap opera star Orpheus Pledger after he failed to appear in court to face charges of assault.

-

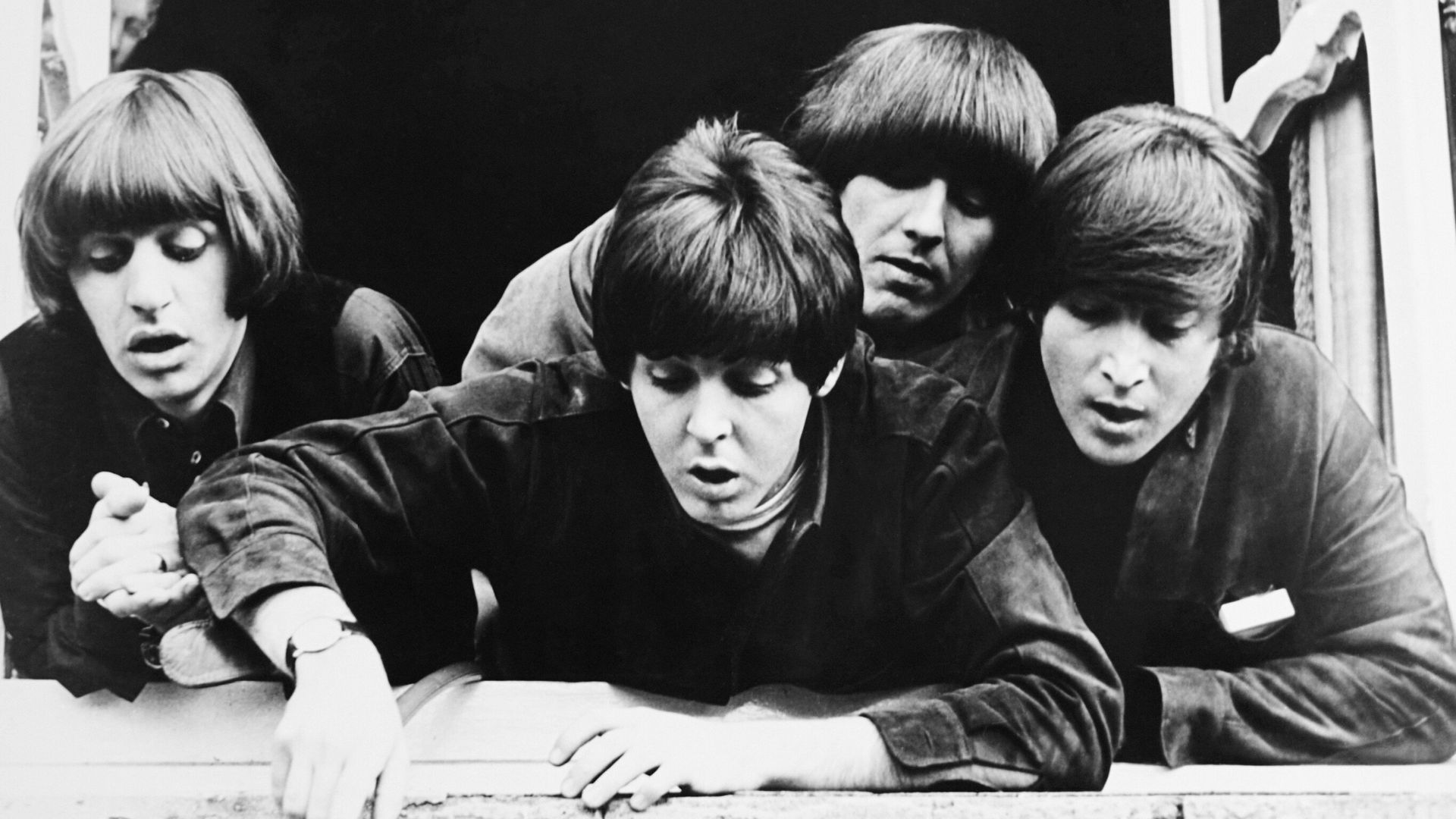

John Lennon's lost guitar found in loft after 50 years to go up for auction

John Lennon's lost guitar found in loft after 50 years to go up for auctionA guitar used by John Lennon in the recording of The Beatles album and film Help! is going up for auction after being found in a loft.

Business News

-

Sainsbury's 'winning over shoppers from rivals' as profits rise

Sainsbury's 'winning over shoppers from rivals' as profits riseSainsbury's has claimed it is winning over customers from its rivals after reporting higher than expected profits.

-

Labour promises publicly owned rail - as Tories slam 'unfunded nationalisation'

Labour promises publicly owned rail - as Tories slam 'unfunded nationalisation'Labour will promise to deliver the biggest shake-up to rail "in a generation" by establishing the long-delayed Great British Railways (GBR) organisation and bringing routes back into public ownership.

-

Sales down at Nestle after price hikes

Sales down at Nestle after price hikesNestle, the world's biggest packaged food company, has reported a fall in sales after hiking its prices.

-

Meta shares take $125bn hit as Facebook owner raises spending forecasts

Meta shares take $125bn hit as Facebook owner raises spending forecastsShares in Meta, the owner of Facebook, WhatsApp and Instagram, have fallen sharply after the company revealed it had raised its cost forecast for the current year.