Schedule

-

-

-

Brian Noon with The Feel Good Afternoon

Brian Noon with The Feel Good Afternoon2:00pm - 4:00pm

The Feel Good Afternoon with the Feel Good Three at Three

-

Top Stories from Sky News

-

Peter Murrell charged in connection with embezzlement of funds from SNP

Peter Murrell charged in connection with embezzlement of funds from SNPNicola Sturgeon's husband Peter Murrell has been charged by police after he was arrested amid an investigation into the SNP's funding and finances.

-

'Jaw-dropping' scandal adds to 'end of days' feel for this Tory government

'Jaw-dropping' scandal adds to 'end of days' feel for this Tory governmentThis is a tale that's more than just a marmalade dropper. It's a story so astounding you have to pick yourself up off the floor.

-

Masked gunman who 'fired wildly' at car on busy London street convicted

Masked gunman who 'fired wildly' at car on busy London street convictedA masked gunman who shot at a car on a busy north London street in a "gang dispute" has been convicted.

-

Schoolboy 'tried to beat sleeping students to death with a hammer', court told

Schoolboy 'tried to beat sleeping students to death with a hammer', court toldA public schoolboy was "on a mission" to protect himself from a "zombie apocalypse" when he tried to kill two sleeping students by attacking them with a claw hammer, a court has been told.

-

Salvator Rosa painting stolen in Oxford raid found in Romania - two other artworks still missing

Salvator Rosa painting stolen in Oxford raid found in Romania - two other artworks still missingAn "'irreplaceable" 17th Century artwork stolen from an Oxford University Gallery has been found in Romania - but police say they're still hunting for two more paintings taken in the heist.

-

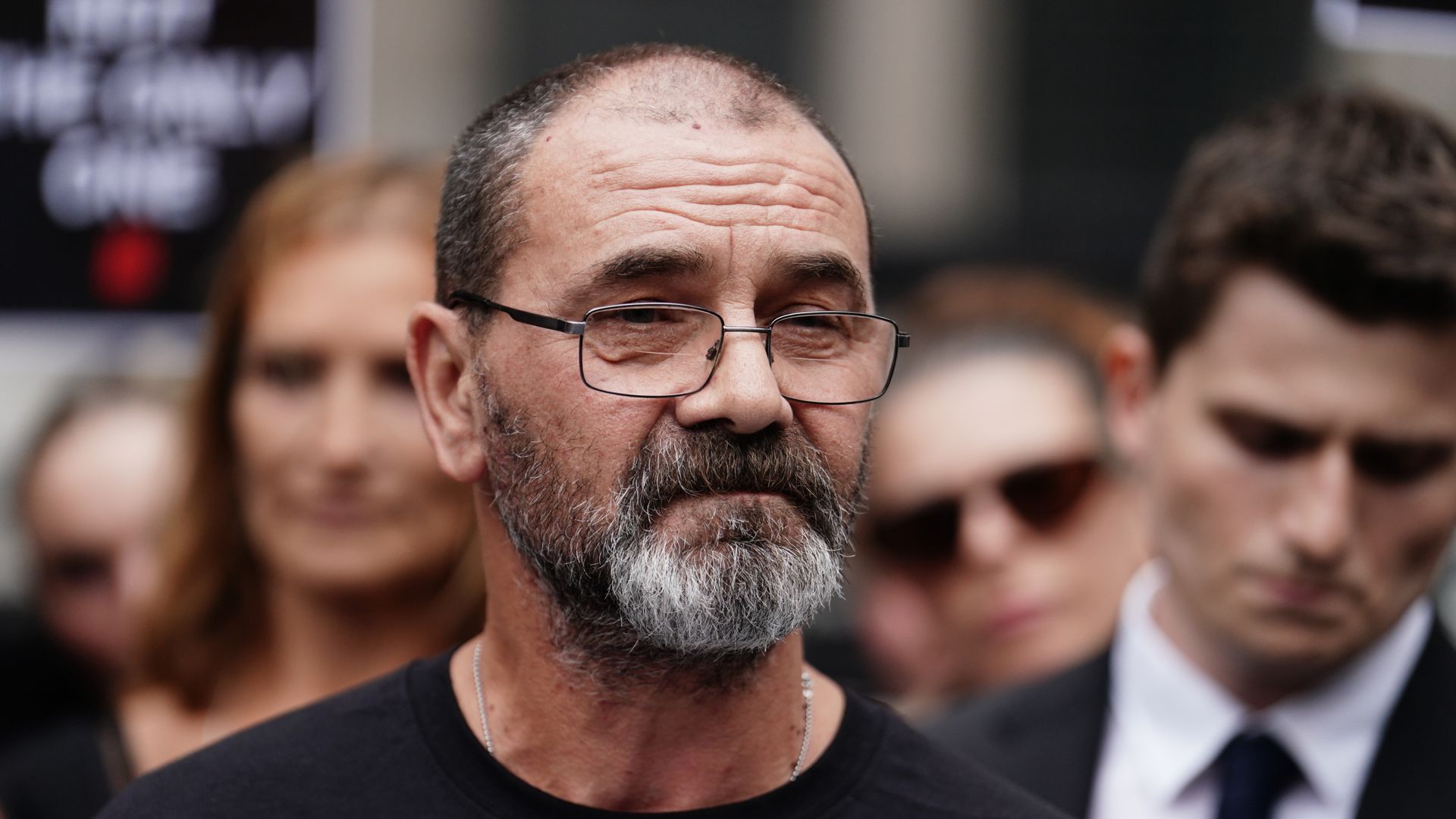

'Too little too late': Man wrongly jailed for 17 years over rape criticises apology

'Too little too late': Man wrongly jailed for 17 years over rape criticises apologyA man wrongly jailed for 17 years for a rape he did not commit has said it is "too little too late" after receiving an apology from the Criminal Cases Review Commission (CCRC).

-

All the Tory MPs who have been suspended since Sunak became PM

All the Tory MPs who have been suspended since Sunak became PMRishi Sunak is facing a fresh headache after a Conservative MP was suspended over allegations he misused campaign funds.

-

Liz Truss's book in breach of rules in place on minister's memoirs

Liz Truss's book in breach of rules in place on minister's memoirsLiz Truss's memoir broke the rules in place for ministers publishing works about their time in office.

Top Entertainment Stories from Sky

-

Taylor Swift reveals 'secret' double album in '2am surprise'

Taylor Swift reveals 'secret' double album in '2am surprise'Taylor Swift has revealed her latest release is a "secret double album" - with 15 more tracks than fans were expecting.

-

Taylor Swift's boyfriend hails latest album as 'unbelievable' - as new track appears to say farewell to British ex

Taylor Swift's boyfriend hails latest album as 'unbelievable' - as new track appears to say farewell to British exTaylor Swift is one of the world's best-selling artists, a billionaire, and a record breaker. And she's just 34.

-

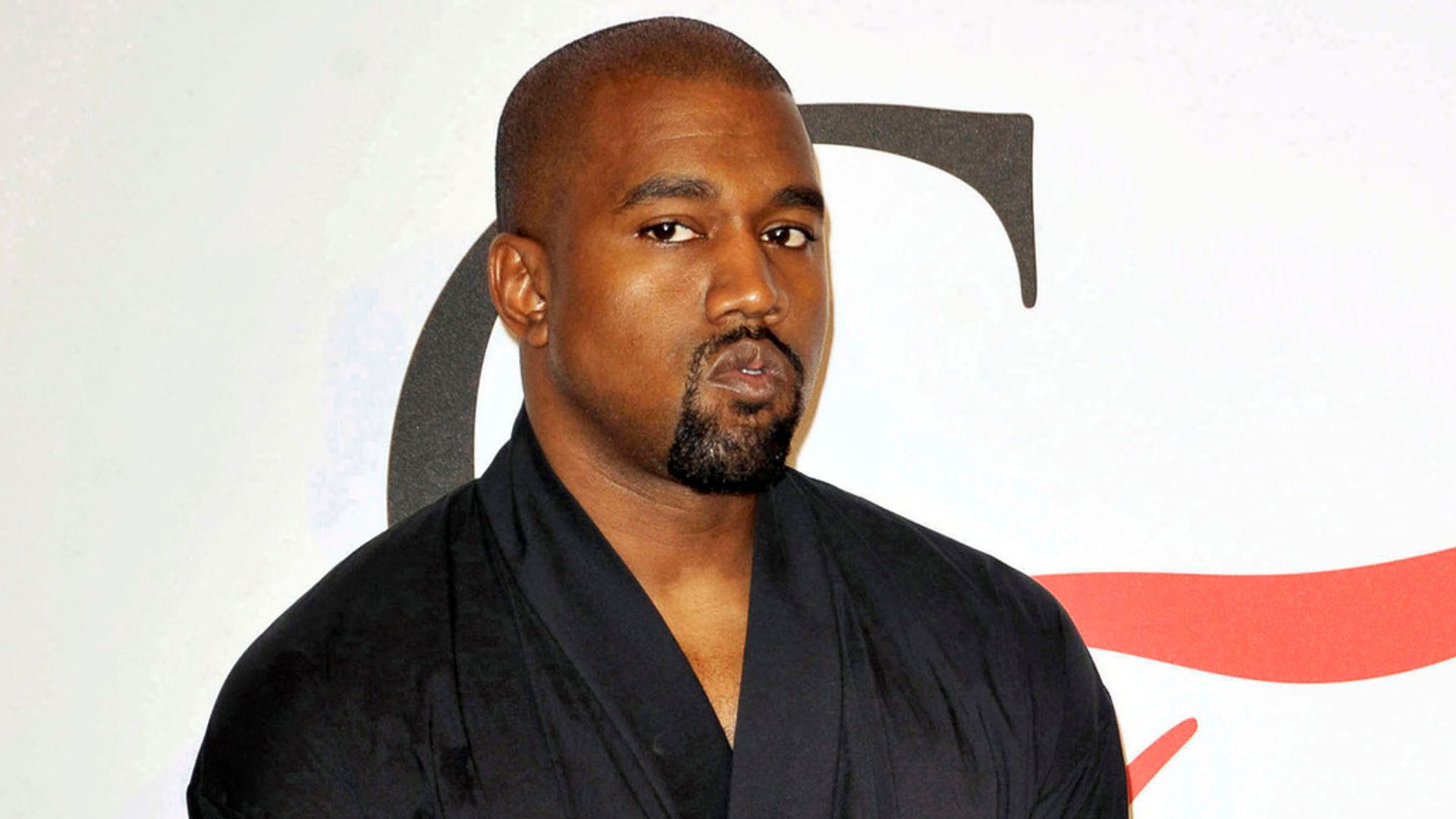

Police investigating whether Kanye West was involved in alleged battery

Police investigating whether Kanye West was involved in alleged batteryPolice in Los Angeles have said they are investigating whether Kanye West was involved in an alleged battery.

-

Harry Styles' stalker jailed after sending him 8,000 cards in less than a month

Harry Styles' stalker jailed after sending him 8,000 cards in less than a monthA woman who stalked Harry Styles has been jailed and banned from seeing him perform.

Business News

-

Retail sales show zero growth despite 'fresh two-year high' for consumer confidence

Retail sales show zero growth despite 'fresh two-year high' for consumer confidenceThere was a worse than expected performance for retail sales last month, defying predictions of a consumer-led pick up from recession for the UK economy.

-

Sunak to demand end to 'sick note culture' and shift focus to 'what people can do'

Sunak to demand end to 'sick note culture' and shift focus to 'what people can do'Rishi Sunak is to call for an end to the "sick note culture" in a major speech on welfare reform - as he warns against "over-medicalising the everyday challenges and worries of life".

-

Post Office had 'bunker mentality' towards press, lawyer tells inquiry

Post Office had 'bunker mentality' towards press, lawyer tells inquiryA sub-postmaster victim of faulty IT software Horizon was described as a "bluffer" when he alerted senior Post Office officials about bugs in the system.

-

Ministers kick off search for new football referee

Ministers kick off search for new football refereeMinisters are to kick off a search for the inaugural chair of the new football watchdog, even as it faces growing hints of opposition to its establishment from the Premier League.