Schedule

-

-

-

Nigel Chorley with The Heritage of Soul

Nigel Chorley with The Heritage of Soul9:00pm - 11:00pm

From the earliest soul artist right up to today's best

-

Top Stories from Sky News

-

Teachers injured in school stabbing incident 'cannot comprehend' what happened

Teachers injured in school stabbing incident 'cannot comprehend' what happenedTwo teachers who were injured in an alleged knife attack at their school have spoken of how difficult it has been to "comprehend" what happened.

-

Deaths of Reading terror attack victims 'probably avoidable', inquest finds

Deaths of Reading terror attack victims 'probably avoidable', inquest findsThe deaths of the Reading terror attack victims were "probably avoidable" and contributed to by the failings of multiple agencies, an inquest has found.

-

Briton accused of arson plot after alleged recruitment as Russian spy

Briton accused of arson plot after alleged recruitment as Russian spyA British man is accused of masterminding an arson plot on London businesses linked to Ukraine after allegedly being recruited as a Russian spy.

-

Teacher admits murdering boyfriend 'in cold blood' and burying body in garden

Teacher admits murdering boyfriend 'in cold blood' and burying body in gardenA primary school teacher has admitted murdering her partner, whose partly mummified remains were discovered four-and-a-half months after he was last seen.

-

School locked down after pupil receives threatening messages

School locked down after pupil receives threatening messagesA school in South Wales was locked down after a teenage pupil allegedly received threatening messages.

-

'I can't believe it': Peter Kay forced to postpone gigs for a second time

'I can't believe it': Peter Kay forced to postpone gigs for a second timePeter Kay says he has been forced to postpone two shows at a new arena in Manchester again - this time for almost a month.

-

Back to public duties - but Prince William is likely being cautious about sharing what's going on in his personal life

Back to public duties - but Prince William is likely being cautious about sharing what's going on in his personal lifeRoyal life is always a bit of a performance - and at the moment you can't help but think how much Prince William is having to put on a brave face.

-

'Enough is enough': Premier League star condemns racist abuse

'Enough is enough': Premier League star condemns racist abuseMarcus Rashford has replied to a supportive post on X, saying he has been suffering abuse "for months" and that "enough is enough".

Top Entertainment Stories from Sky

-

'I can't believe it': Peter Kay forced to postpone gigs for a second time

'I can't believe it': Peter Kay forced to postpone gigs for a second timePeter Kay says he has been forced to postpone two shows at a new arena in Manchester again - this time for almost a month.

-

Jack Whitehall reacts after Prince William calls his jokes 'dad-like'

Jack Whitehall reacts after Prince William calls his jokes 'dad-like'Jack Whitehall says he's been the victim of "outrageous shading" after the Prince of Wales described his jokes as "dad-like".

-

Actress Emma Stone says she 'would like to be' called by her real name

Actress Emma Stone says she 'would like to be' called by her real nameHollywood actress Emma Stone has revealed she would prefer to be known by her real name - Emily.

-

Home And Away star arrested after manhunt

Home And Away star arrested after manhuntFormer Home And Away star Orpheus Pledger has been arrested following a three-day police manhunt for the actor, according to Australian media reports.

Business News

-

Russia sanctions-busting? Big questions remain over UK car exports

Russia sanctions-busting? Big questions remain over UK car exportsThe extraordinary, unprecedented and largely unexplained flows of millions of pounds of British luxury cars into states neighbouring Russia continued in February, according to new official data.

-

Superdry landlord M&G eyes challenge to rescue plan

Superdry landlord M&G eyes challenge to rescue planThe owner of Superdry's flagship store in central London is weighing a challenge to a rescue plan that would impose steep haircuts on the struggling chain's landlords.

-

NatWest becomes latest UK bank to report sharp drop in profits

NatWest becomes latest UK bank to report sharp drop in profitsNatWest Group has become the latest UK banking giant to report a sharp drop in earnings for the first three months of the year.

-

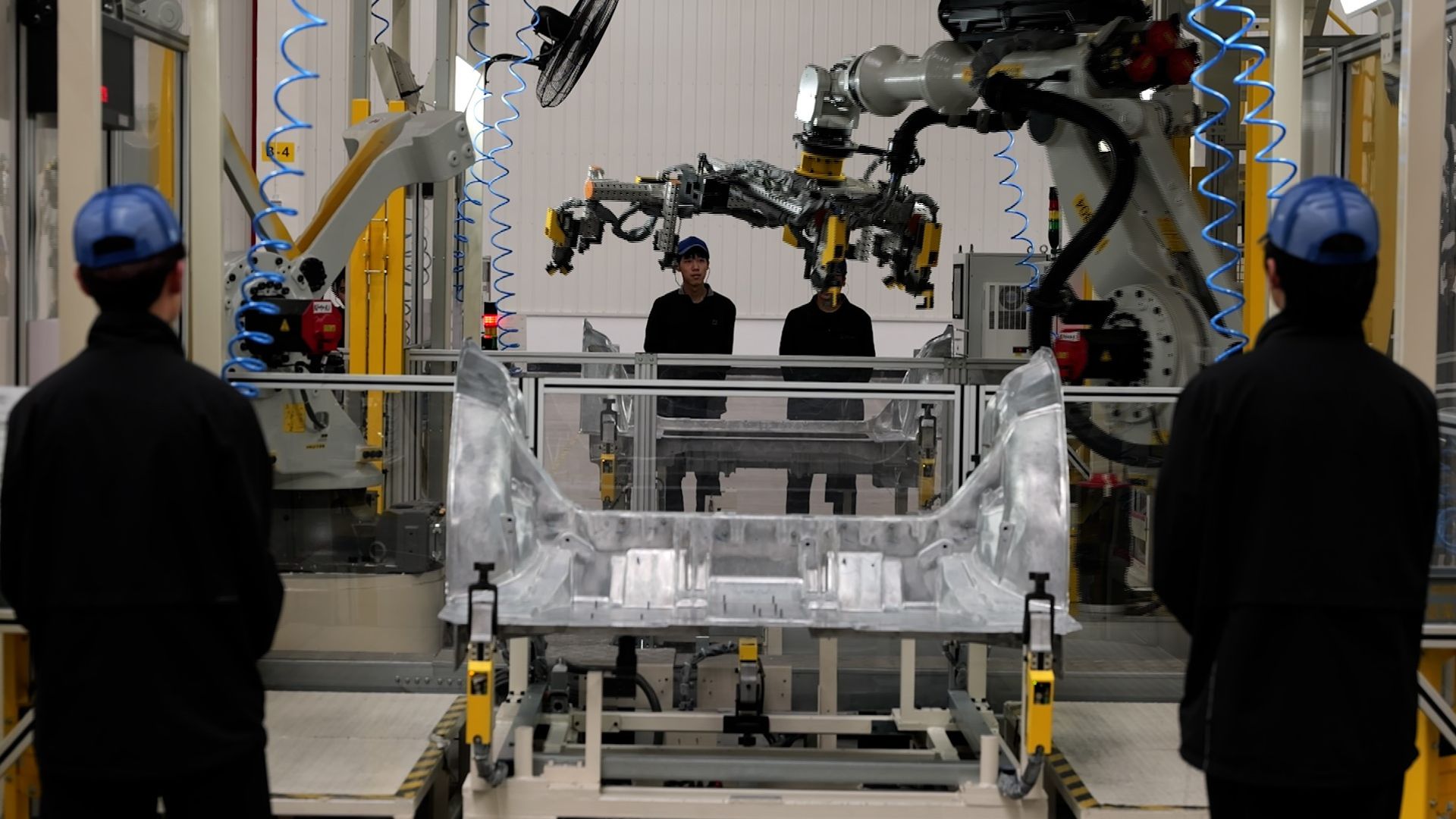

There's a new trade war brewing - over global dominance in the electric car market

There's a new trade war brewing - over global dominance in the electric car marketThere's a trade war brewing between China and the West, at stake is who will dominate the global market for electric vehicles.