Top Stories from Sky News

-

Officers who failed to spot murder victim had been shot could face misconduct inquiry

Officers who failed to spot murder victim had been shot could face misconduct inquiryOfficers who failed to spot a murder victim had been shot could face a misconduct inquiry, a former senior detective has told Sky News.

-

Teenage girl arrested on suspicion of attempted murder after stabbings at school

Teenage girl arrested on suspicion of attempted murder after stabbings at schoolA teenage girl has been arrested on suspicion of attempted murder after two teachers and a pupil were stabbed at a school in West Wales.

-

Labour promises publicly owned rail - as Tories slam 'unfunded nationalisation'

Labour promises publicly owned rail - as Tories slam 'unfunded nationalisation'Labour will promise to deliver the biggest shake-up to rail "in a generation" by establishing the long-delayed Great British Railways (GBR) organisation and bringing routes back into public ownership.

-

'Politicians mess it up every time': New pre-election pledges may not be enough in the North East

'Politicians mess it up every time': New pre-election pledges may not be enough in the North EastJune gives me a wry smile when I ask her if she trusts politicians. But it soon fades.

-

Three men arrested after deaths of five people, including a child, who attempted to cross Channel

Three men arrested after deaths of five people, including a child, who attempted to cross ChannelThree men have been arrested after the deaths of five people - including a seven-year-old girl - who were attempting to cross the English Channel.

-

Young girls in UK drink, smoke and vape 'more than boys'

Young girls in UK drink, smoke and vape 'more than boys'Young girls in the UK drink, smoke and vape more than boys, a major study suggests.

-

Most plant-based meat and dairy alternatives have lower saturated fat and higher fibre, study finds

Most plant-based meat and dairy alternatives have lower saturated fat and higher fibre, study findsMost plant-based meat and dairy alternatives have lower levels of saturated fat and higher fibre than their animal-derived counterparts, researchers have found.

-

'Spooked' horses cause 'total mayhem' after bolting through central London

'Spooked' horses cause 'total mayhem' after bolting through central LondonMilitary horses have caused "total mayhem" after bolting during exercises and charging through central London in rush hour.

Top Entertainment Stories from Sky

-

Baby Reindeer writer tells fans to stop speculating about who characters are in real life

Baby Reindeer writer tells fans to stop speculating about who characters are in real lifeRichard Gadd has urged fans of his hit show Baby Reindeer to stop speculating about who the characters in his show are based on in real life.

-

Manhunt for Home and Away star accused of assault

Manhunt for Home and Away star accused of assaultPolice in Australia have launched a manhunt for former soap opera star Orpheus Pledger after he failed to appear in court to face charges of assault.

-

John Lennon's lost guitar found in loft after 50 years to go up for auction

John Lennon's lost guitar found in loft after 50 years to go up for auctionA guitar used by John Lennon in the recording of The Beatles album and film Help! is going up for auction after being found in a loft.

-

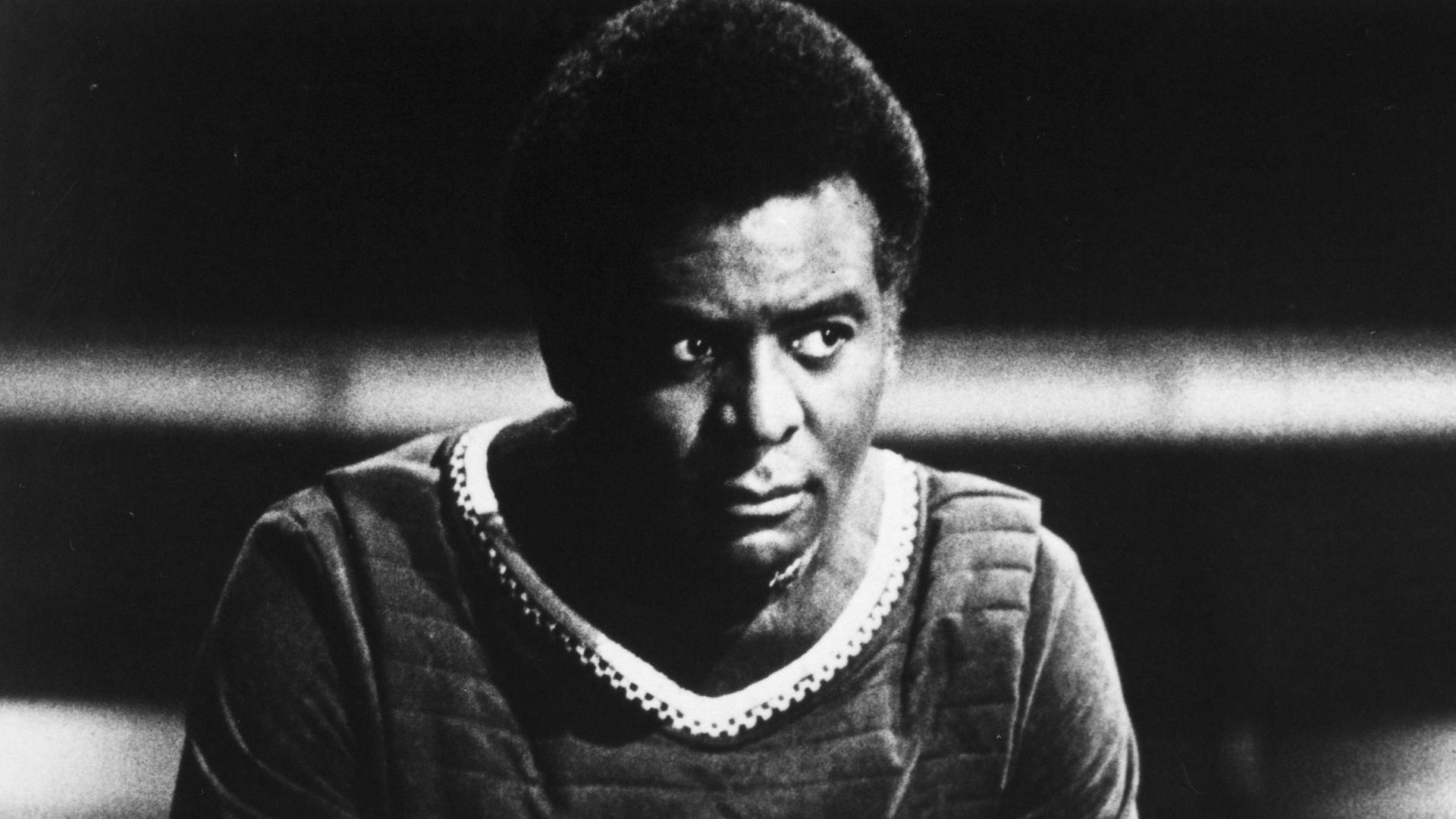

Star of iconic 70s series Battlestar Galactica dies

Star of iconic 70s series Battlestar Galactica diesUS actor Terry Carter, who starred in 1970s TV shows including Battlestar Galactica and McCloud, has died at the age of 95.

Business News

-

Suez Canal traffic falls 66% after attacks on Red Sea shipping

Suez Canal traffic falls 66% after attacks on Red Sea shippingShipping traffic through the vital Suez Canal artery in Egypt has plunged by 66% since cargo was forced to divert due to attacks on vessels, according to official figures.

-

Meta shares take $125bn hit as Facebook owner raises spending forecasts

Meta shares take $125bn hit as Facebook owner raises spending forecastsShares in Meta, the owner of Facebook, WhatsApp and Instagram, have fallen sharply after the company revealed it had raised its cost forecast for the current year.

-

Premier League toasts £40m deal with new beer partner Guinness

Premier League toasts £40m deal with new beer partner GuinnessEnglish football's top flight is toasting a £40m sponsorship deal with Guinness after the Diageo-owned brand saw off competition from Heineken.

-

Former England and Liverpool star banned as company director over unpaid taxes

Former England and Liverpool star banned as company director over unpaid taxesJohn Barnes has been banned as a director after his company failed to pay almost £200,000 in tax.