Top Stories from Sky News

-

King to return to public-facing duties following positive response to cancer treatment

King to return to public-facing duties following positive response to cancer treatmentThe King is to return to public-facing royal duties, with his medical team "very encouraged" by the progress made in his cancer treatment.

-

'This tragedy didn't have to happen': How knife attack by ex-child soldier could have been stopped

'This tragedy didn't have to happen': How knife attack by ex-child soldier could have been stoppedWhen three men were stabbed to death in Reading's Forbury Gardens on Saturday 20 June 2020, Nick Harborne instantly knew Khairi Saadallah was responsible.

-

Mother describes having Christmas drink with son's killer girlfriend 'a few feet away' from his body

Mother describes having Christmas drink with son's killer girlfriend 'a few feet away' from his bodyThe mother of a man who was murdered by his girlfriend and buried in their garden has described the moment she was unknowingly just a few feet away from his body.

-

Teachers injured in school stabbing incident 'cannot comprehend' what happened

Teachers injured in school stabbing incident 'cannot comprehend' what happenedTwo teachers who were injured in an alleged knife attack at their school have spoken of how difficult it has been to "comprehend" what happened.

-

-

Liverpool reach agreement in principle with Feyenoord over Klopp's successor

Liverpool reach agreement in principle with Feyenoord over Klopp's successorFeyenoord boss Arne Slot is set to replace Jurgen Klopp as Liverpool manager.

-

British tourist attacked by shark in Trinidad and Tobago

British tourist attacked by shark in Trinidad and TobagoA British tourist is in intensive care after being attacked by a shark in Trinidad and Tobago.

-

Horses that bolted through London being 'observed' after surgery - with others to return to duty

Horses that bolted through London being 'observed' after surgery - with others to return to dutyMilitary horses that were were injured after they bolted through central London earlier this week will be "closely observed" - as the army says some of the animals will return to duty "in due course".

Top Entertainment Stories from Sky

-

'I can't believe it': Peter Kay forced to postpone gigs for a second time

'I can't believe it': Peter Kay forced to postpone gigs for a second timePeter Kay says he has been forced to postpone two shows at a new arena in Manchester again - this time for almost a month.

-

Jack Whitehall reacts after Prince William calls his jokes 'dad-like'

Jack Whitehall reacts after Prince William calls his jokes 'dad-like'Jack Whitehall says he's been the victim of "outrageous shading" after the Prince of Wales described his jokes as "dad-like".

-

Actress Emma Stone says she 'would like to be' called by her real name

Actress Emma Stone says she 'would like to be' called by her real nameHollywood actress Emma Stone has revealed she would prefer to be known by her real name - Emily.

-

Home And Away star arrested after manhunt

Home And Away star arrested after manhuntFormer Home And Away star Orpheus Pledger has been arrested following a three-day police manhunt for the actor, according to Australian media reports.

Business News

-

Russia sanctions-busting? Big questions remain over UK car exports

Russia sanctions-busting? Big questions remain over UK car exportsThe extraordinary, unprecedented and largely unexplained flows of millions of pounds of British luxury cars into states neighbouring Russia continued in February, according to new official data.

-

Superdry landlord M&G eyes challenge to rescue plan

Superdry landlord M&G eyes challenge to rescue planThe owner of Superdry's flagship store in central London is weighing a challenge to a rescue plan that would impose steep haircuts on the struggling chain's landlords.

-

NatWest becomes latest UK bank to report sharp drop in profits

NatWest becomes latest UK bank to report sharp drop in profitsNatWest Group has become the latest UK banking giant to report a sharp drop in earnings for the first three months of the year.

-

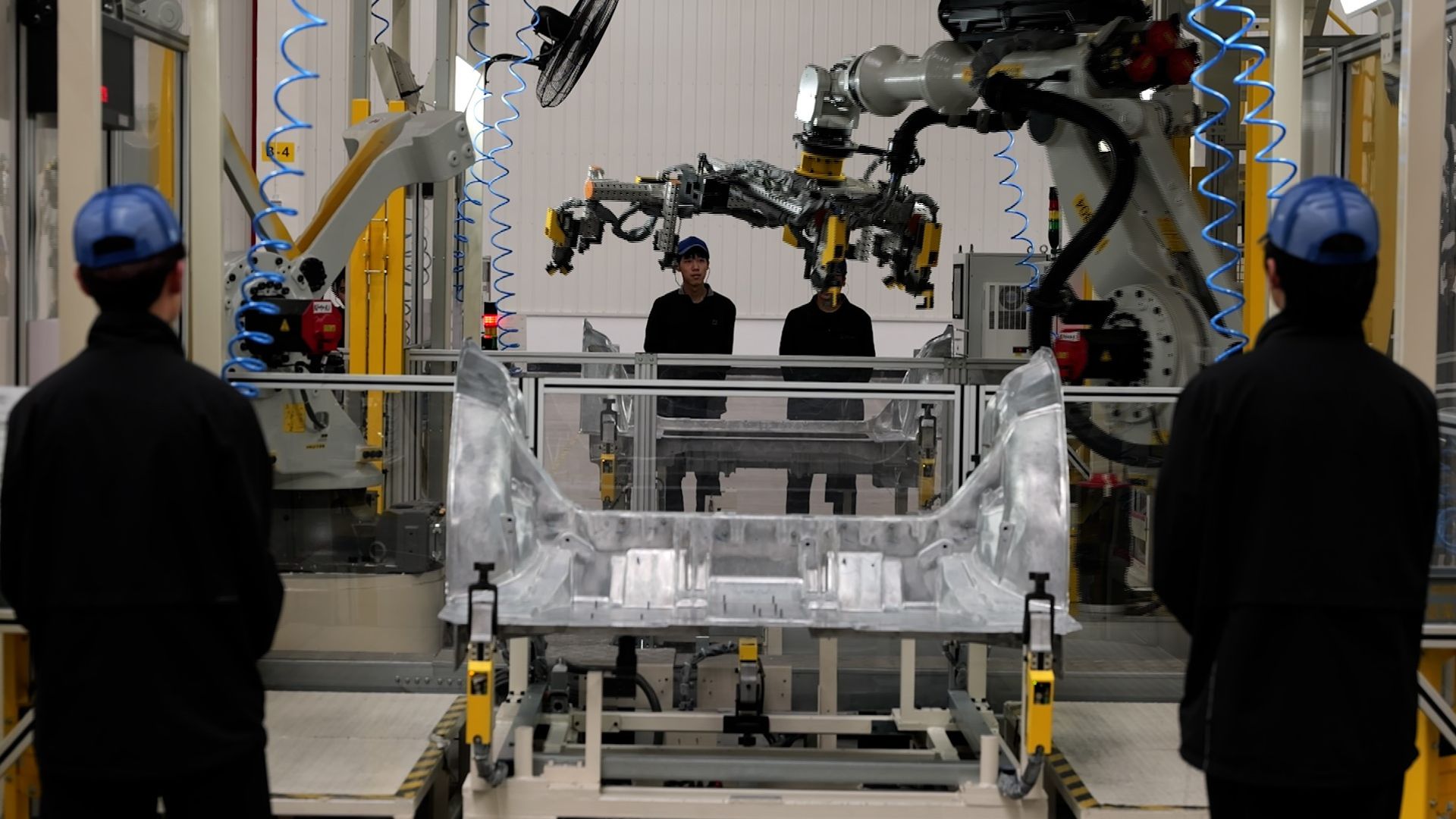

There's a new trade war brewing - over global dominance in the electric car market

There's a new trade war brewing - over global dominance in the electric car marketThere's a trade war brewing between China and the West, at stake is who will dominate the global market for electric vehicles.